http://web.mac.com/videopalitalia/iWeb/Site/Photos.html

NOW IS THE TIME FOR ALL GOOD PEOPLE TO COME TO THE AID OF THEIR COUNTRY!

POPULAR SEARCHES:

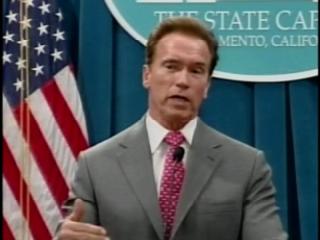

BERKELEY, Calif. – Business consultant Katrina Kennedy has taken her young son out of preschool and put a family vacation on hold. Dairyman Mike O'Kelly is wondering whether he is going to have to let employees go.

The problem? They rely on contracts with state agencies for much of their business and, cash-strapped California may start sending them IOUs instead of money until the state has enough cash to cover all payments.

"I've dealt with the state for many, many years, and the failure of the state to come up with a budget has always caused problems for July and August," said O'Kelly, owner of Morning Glory Inc. in Susanville, which supplies milk and eggs to prisons. "This particular economic crisis, however, has me more worried than all of the others combined."

The reason for the IOUs is California's $26.3 billion deficit. Lawmakers have not been able to agree on a balanced budgetby cutting spending, raising taxes or both.

Without a balanced budget, the state controller's office says the treasury does not have enough cash to meet all its financial obligations. So IOUs were scheduled to go out beginning Thursday to private contractors, state vendors, people getting tax refunds and local governments for social services.

Assistance payments to elderly, blind and disabled people will be disbursed as usual, because the federal government is paying the state's share.

For California's small businesses and social agencies, which are accustomed to a Legislature that rarely meets the June 30 budget deadline, a lean summer is not new. Most say they expect to cope despite delays in getting paid.

Wells Fargo, Bank of America and Chase bank say they will accept IOUs from existing customers through July 10, while other banks haven't decided. Some credit unions also said they'll take IOUs, but it was unclear if payday lending businesses would cash them.

Most small businesses and social agencies are confident the state will come through eventually, and say it's a matter of when — not if — they'll get their money. Still, having the government of the world's eighth-largest economy resort to IOUs creates uncertainty.

"Getting an IOU through the summer months — I'd rather have the money, but we're prepared for it," said Kennedy, who runs management training programs for a number of state agencies. "It's when it goes past September and into October, which I'm completely anticipating this year, that things begin to get really tight."

State Controller John Chiang, who plans to issue about $3.3 billion in IOUs this month along with nearly $11 billion in regular payments, was scheduled to start printing the IOUs on Thursday, marking the first time since 1992 the state has found itself in this position.

Last time around, the IOUs went to state workers in place of paychecks, and the workers filed suit. A federal judge ruled it was a violation of the Fair Labor Standards Act, and the issue eventually was settled with the workers getting extra vacation time or, if they no longer worked for the state, cash payments.

So far, no lawsuits have been threatened over the latest round of IOUs.

The latest IOUs, called individual registered warrants, will be redeemable with interest in October by banks, individuals or anyone who still has them. The interest rate was set at 3.75 percent.

Bank of America will stop accepting IOUs after July 10 but will try to assist those customers in other ways, perhaps by waiving fees or making other arrangements on payments, bank officials said.Wells Fargo and Chase didn't elaborate on their plans for IOUs after July 10.

The California crisis came as lawmakers in several other states wrestled with recession-wracked budgets.

In Illinois, the legislative session ended with no plan for paying state employees or delivering services. In Pennsylvania, the governor is proposing a 16 percent tax increase.

Though the crisis has been coming for a while, some cannot believe California has gotten itself to this point.

"Twenty-four billion dollars — that's just a number I can't even wrap my mind around," said Lynn Merritt, whose small business provides office supplies to several state agencies.

Getting IOUs for payment "would be terrible as a business person, and it would put me in a really bad bind," she said, "but they can't just keep going like they are."

___

On the Net:

California State Controller's Office, http://www.sco.ca.gov

Most Blogged - Top Stories

- McCain Draws A Blank When Asked About Arizona Sheriff Joe Arpaio Think Progress – Thu Jul 2, 9:08 pm EDT

- Town Hall Plants Take 2: Once Again... All of the Audience Members Called On By Obama Were SupportersGateway Pundit – Thu Jul 2, 6:49 pm EDT

- Foreign Policy: This Week at War, No. 23 Foreign Policy – Thu Jul 2, 3:51 pm EDT

Alerts

Get an alert when there are new stories about:

View More Alerts »Daily Features

All Comics »

All Comics »Opinions & Editorials: Diverse views on news from the right, left, and center.

All Opinion »

Photo Highlight

Photo Highlight Slideshow

A jet flies past the waxing moon over Zurich. REUTERS/Arnd Wiegmann

More Photos and Slideshow »Copyright © 2009 The Associated Press. All rights reserved. The information contained in the AP News report may not be published, broadcast, rewritten or redistributed without the prior written authority of The Associated Press.

Digg

Digg StumbleUpon

StumbleUpon Reddit

Reddit MixxShareThis

MixxShareThis